🚀 Instant transfers

💰 Low competitive fees

💁 Dedicated success specialists

🤑 Early pay-off discount

🏷️ Save - pay off early 50% off fees

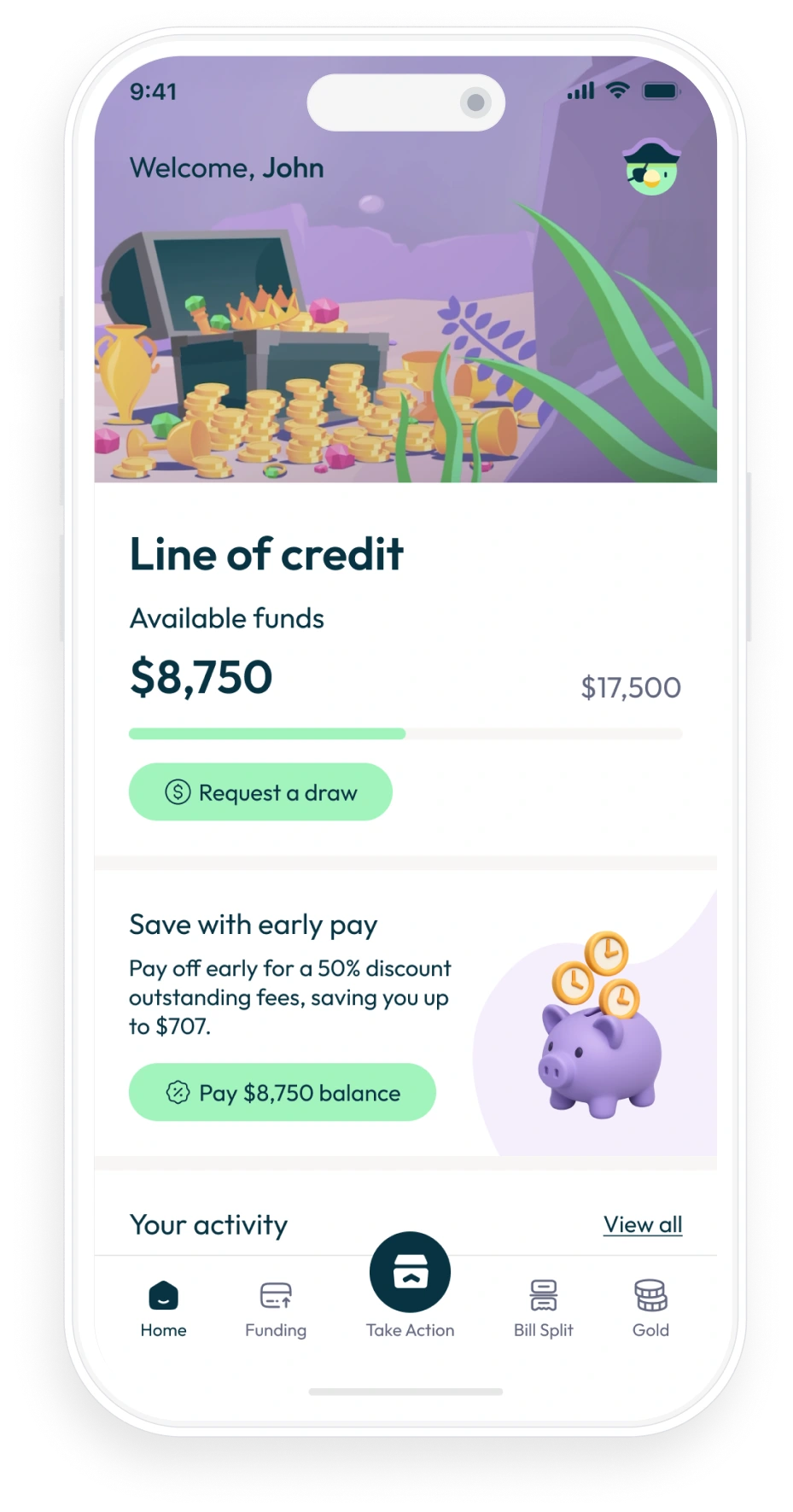

Loot

Loot for growing businesses

Got unexpected needs for inventory, repairs, payroll, materials, or just a steadier cash flow? This line of credit is built for established small businesses ready to sail smoother seas.

What is a line of credit?

Why choose a line of credit?

Simple application

5 minute online application. No document uploads necessary.

High limits

From $5,000 to $100,000.

Same day funding

Funds can be sent to your business bank account as fast as the same day.

Flexible and convenient

Draw down and access capital whenever you need it.

Qualify in no time

No need for parchment or proof - just link your bank and we'll do the rest.

Minimum requirements

Time in business

1 year

Annual revenue

$200k

FICO

None